DNS Realty Group

Premier Boutique Real Estate Brokerage

Residential | Commercial

Understanding The Importance Of Credit When Buying A Home

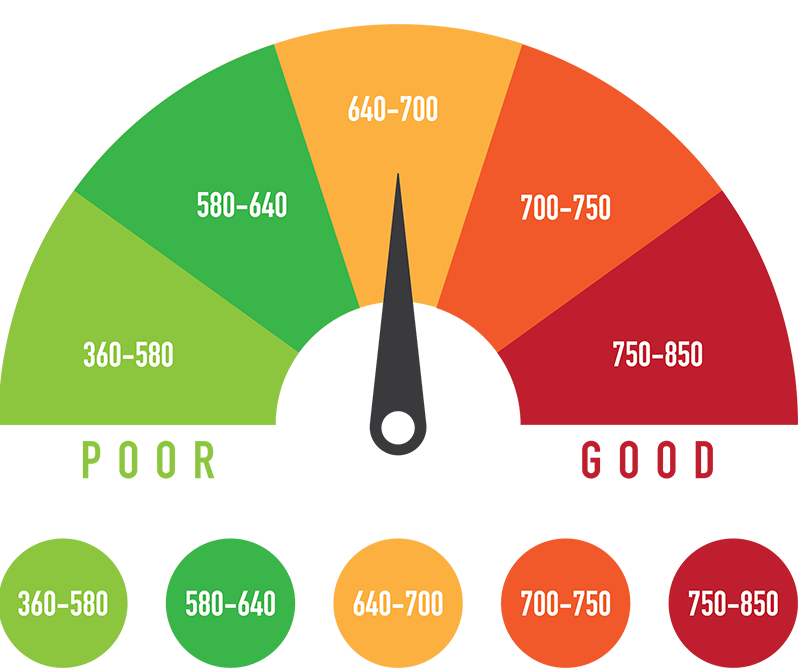

If you are thinking about purchasing a home, your credit score is the most important factor. Generally, a higher score means a better chance at qualifying for a loan and getting the best interest rate possible.

Lenders are looking for information in your credit report in order to determine your creditworthiness - what is the likelihood that you will have the means to repay the loan. Let’s take a look at a few top factors that could affect your credit score:

1. Payment History - This continues to be one of the largest, single factors. Paying your bills on time can mean the difference between poor, average and exceptional credit.

2. Amount Borrowed Compared To Available Credit - A major component of your credit score, is the amount of revolving debt you owe in relation to your available balances. It is calculated on an individual account basis and an overall basis. The exact weighting of this factor can vary depending on how long you have been using credit. Your total amount of debt plays a large role in your credit score.

3. Length of Credit History - An individual with a credit score over 800 typically hold at least three credit cards (with very low balances) which they have had open for over seven years each. Rather than closing accounts with a zero balance; it is best to work toward paying them off, and then let the accounts remain open with a a small amount of activity that is paid off each month.

4. Inquiries and New Debt - Inquiries on your credit file and new debt also affect your credit score. The good news; if you are shopping for a house, all mortgage inquiries within thirty days of each other will be grouped as one inquiry. For autos, it is a fourteen day limit.

5. Type of Debt - The type of credit/debt you hold; installment vs. revolving debt, will have varying effects on your credit score. Installment debt, such as an auto loans, is looked upon more favorably than revolving (credit cards) debt.

Sound words of advise: Monitor your spending habits; prioritize keeping a close watch on your credit score. And understand that this diligent fiscal behavior will repay you with huge dividends when seeking your dream home.

DNS Realty Group

Waldorf, MD 20602